Market Access Charge Would Eliminate Trade Deficit & Increase GDP

In July 2017, the Coalition for a Prosperous America (CPA) released a paper titled, “The Threat of U.S. Dollar Overvaluation: How to Calculate True Exchange Rate Misalignment & How to Fix It” by Michael Stumo (CEO), Jeff Ferry (Research Director) and Dr. John R. Hansen, a 30-year veteran of the World Bank and Advisory Board member.

The purpose of the paper is to explain the problem of the dollar overvaluation, to show how to accurately calculate the dollar’s misalignment against trading partner currencies, and to propose a solution this serious threat to America’s future. At the time, the dollar was overvalued by 25.5% compared to other major currencies.

The solution developed by Dr. Hansen is a Market Access Charge (MAC) “as a system to discourage overseas private investors and return-sensitive official investors such as sovereign wealth fund managers from excessive speculation and trading in U.S. dollar assets.” He believed that the MAC would reduce “the incentive for foreigners to invest in dollars, gradually and safely reduce its overvaluation, benefiting the U.S. economy and restoring control over our own currency.”

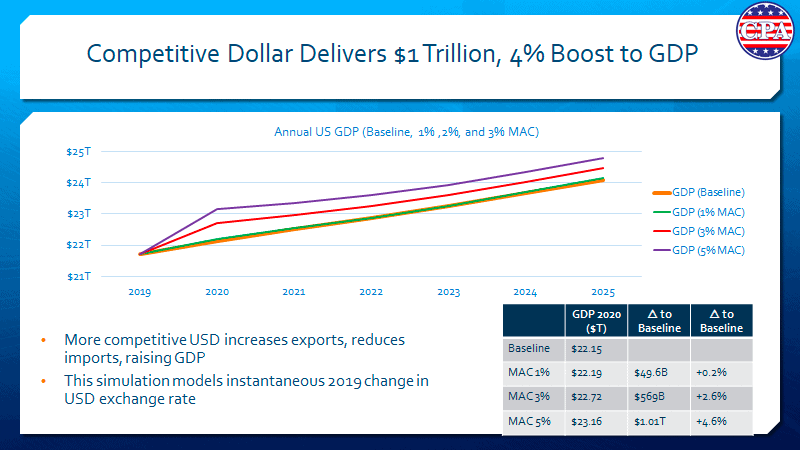

In February 2019, CPA released the working paper, “Quantifying Economic Growth and Job Creation from a competitive Dollar,” showing that a 27 percent realignment in the trade weighted US dollar exchange rate over five years would eliminate the US trade deficit, result in an additional $1 trillion in GDP and create 5.2 million new jobs.

The MAC was proposed in a Senate bill introduced in July 2019, S.2357, titled the “Competitive Dollar for Jobs and Prosperity Act.” It was introduced by Sen. Tammy Baldwin (D-WI) and Josh Hawley (R-MO), and is languishing in the Senate Committee on Banking, Housing, and Urban Affairs.

On October 5, 2020, CPA released a working paper, “Modeling the Effect of the Market Access Charge on Exchange Rates, Interest Rates and the US Economy,” by Steven L Byers, PhD. and Jeff Ferry.

In Section 1, The Relationship Between International Capital Flows and the Exchange Rate, the authors state that

“The standard open-economy macroeconomic models predict that under a floating exchange rate regime, when a country runs a trade deficit/surplus, the exchange rate will adjust to eliminate the imbalance. However, exchange rates have not adjusted and imbalances have persisted. The US trade and current account deficits have continued to run at some 2%-3% of US GDP for decades (Figure 1), suggesting that other forces are preventing the deficits from correcting themselves.”

The authors go into detailed economic models that establish the relationship between equity inflows and the currency dollar exchange rate.

In Section 2, The MAC, Capital Flows and the Dollar Exchange Rate, the authors examined how a charge on capital inflows is likely to impact inflows and the exchange rate, focusing on the Market Access Charge (MAC) discussed above. The authors state:

“The MAC would be a one-time fee paid on the purchase of any U.S. dollar financial asset by a foreign entity or individual. The MAC is designed to moderate foreign demand for dollar assets and realign the US dollar exchange rate to a trade-balancing level. The Baldwin-Hawley bill specifies that the Federal Reserve Board would set and manage the MAC to achieve current account balance within a five-year time horizon. Once balance was achieved, the Fed would manage the MAC to keep the US economy close to current account balance over time. “The Baldwin-Hawley bill specifies that the Federal Reserve Board would set and manage the MAC to achieve current account balance within a five-year time horizon. Once balance was achieved, the Fed would manage the MAC to keep the US economy close to current account balance over time.”

This section covers detailed economic models on how the MAC would affect different kinds of equity flows, such as bonds, Treasury notes

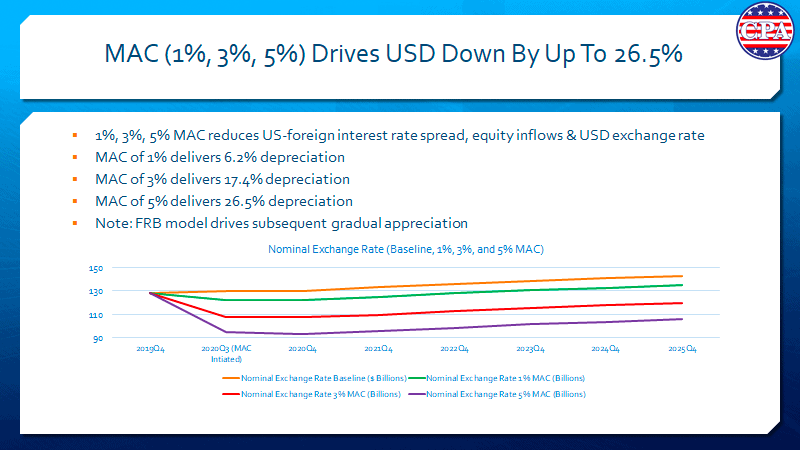

In Section 3, How the MAC Impacts Interest Rates, the authors “sought to estimate the impact of the MAC on the financial sector with a focus upon interest rates and government debt service costs.” They investigated and modeled the effect of a 1%, 3%, and 5% MAC on the nominal exchange rate, 10-year interest rates, and interest rate on outstanding Federal debt.

With regard to revenue the MAC would generate for the US Treasury, the authors comment,

“Though the MAC would reduce capital inflows significantly, our model suggests that even with a 5% MAC, gross equity inflows would continue at a rate in excess of $3 trillion a quarter, with inflows into debt securities at similar levels. MAC transaction fees, paid by foreign purchasers of US securities, would provide a large new source of revenue to the US Treasury. Table 4 shows that these revenues could reach $672 billion, equivalent to 19% of last year’s total federal tax revenue.”

In Section 4, Effects on the Economy, the authors state:

“…US producers of goods and services would gain market share in the US market and export markets. Our model estimates the impact of increased domestic production over the five-year period on US GDP and employment. In the case of a 5% MAC, the dollar’s exchange value would fall by 27…the more competitive dollar would balance trade, increasing exports by $765 billion or 29.5% over the baseline, and reducing imports by $167 billion (5.1%). The fall in imports is modest because while imports lose share in the domestic market, the rise in economic growth from the more competitive exchange rate boosts GDP, which leads to higher imports. But trade would be balanced. The GDP would rise by $1.01 trillion or 4.6%. Compared to the baseline forecast, the economy would create 4.9 million new jobs by 2025… the new jobs would be weighted towards internationally competitive sectors, notably manufacturing and natural resources, which offer higher pay (and often better benefit packages) than the average US job.”

The authors conclude that “The model shows large benefits to the US economy and the US Treasury. Further study is warranted and should be pursued.”

I would go one step further and say that the Baldwin-Hawley “Competitive Dollar for Jobs and Prosperity Act.” (S. 2357) should be released out of committee as soon as possible to be debated and then passed in the full session of the Senate. Reducing our trade deficit, increasing our GDP, and creating more higher-paying manufacturing jobs are important actions to be taken to create prosperity in America.

Leave a Reply

Want to join the discussion?Feel free to contribute!